The Georgia Green Party encourages all Georgians to demand of their Congressional Representatives that they investigate, expose and prosecute the entire Epstein network of pedophiles and traffickers. The party is proud to join the demand of Epstein Justice (https://epsteinjustice.com/) for… Continue Reading →

Without further research we cannot pinpoint the date when Green Party activists first started calling the Occupation’s response to the October 2023 Operation al-Aqsa Flood a genocide. But we know that the Georgia Green Party’s annual convention on May 18th,… Continue Reading →

On May 24, 2025, the Georgia Green Party is convening its 2025 Annual Convention from 1 pm to 6 pm.

Pre-registration is required for virtual participants and encouraged by those who will attend in person. You may register here: http://db.georgiagreenparty.net/civicrm/event/info?id=181&reset=1.

We will gather at the Brownwood Recreation Center, 602 Brownwood Avenue SE, Atlanta, GA 30316.

If you are unable to attend in person, we hope to provide an option for remote participants.

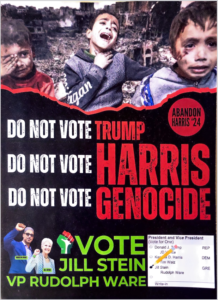

Two days ago, a two-plus decade long supporter of our efforts to build a new political party in Georgia called me with a great deal of anger and fear for another Trump administration to argue that ‘now is not the time’ for us to put at risk the chances for the Party of Genocide to retain the White House.

Yet, every election cycle is an opportunity to build political power independent of the corporate duopoly parties. Any election cycle not used for that purpose is wasted and sets back whatever progress we have made in previous election cycles. To demur at this time is to shrink from the challenge put before us. No one else will build this party but us.

When we registered on May 8th, 1996 with the Secretary of State as a political organization in Georgia, we said in our registration statement that our Party “is being organized to provide an electoral tool for the grassroots movement for social justice, peace and non-violence, participatory democracy and ecological sustainability”. In this year, the movement for peace and opposed to genocide has rallied around the campaign we mount as a vehicle vital to the expression of their political aspirations for this country. It would be a tragic abdication were we, at this late date, to withdraw from the field, to decline to participate or to deny the peace movement an opportunity to use the party we have built as a vehicle for their efforts.

We are hearing from the muslim supporters of our campaign that this is a time for sacrifice; that the sacrifices we are asked to make pale in comparison to the sacrifices being endured by our neighbors in Gaza and Palestine, in Syria and Libya and Yemen. They are urging us to take the risks demanded by our desire for change. We are listening as muslim advocates for the the Stein-Ware 2024 campaign push back against the bullying by democrats who express entitlement to our votes, reminding our communities that now is the time that we must play the long-game.

If our muslim neighbors are willing to risk another Trump administration, with its muslim bans and moving the US embassy to the contested city of Jerusalem and the heightened islamophobic rhetoric, certainly we can share that risk. Solidarity requires that we overcome the fear, that we share the sacrifice, that we face threats together.

And ultimately we can push back against the blue team’s bully tactics with a show stopping question of our own: what evil could possibly be greater than genocide?

The following was authored by a coastal Texan active with the Abandon Harris campaign.

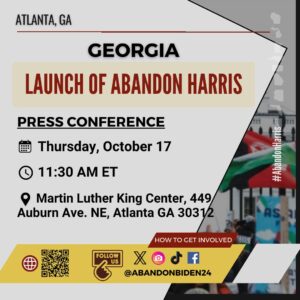

Abandon Harris to Launch Georgia Campaign

Georgia Green Party welcomes national effort, endorsement

A Media Advisory

Event: Press Conference

Date/Time: Thursday, October 17th, 2024 at 11:30 am

Place: Martin Luther King Center; 449 Auburn Avenue; Atlanta GA 30312

As their website puts it, “The Abandon Harris Campaign (formerly the Abandon Biden Campaign) seeks to empower people of conscience to leverage their vote for the US presidency and, consequently, effect moral change in the United States and around the world.” The strategy is simple: encourage voters to reject Harris and Trump, and any party complicit in war and genocide, by supporting candidates like Dr. Jill Stein who stand firmly against these atrocities. Last week, Abandon Harris officially endorsed Dr. Stein.

This endorsement reflects a significant shift, showing that people of conscience are moving away from traditional party lines to support leaders who align with their principles against genocide. Polling among Muslim voters shows that the non-Trump vote among Muslims is evenly split between Harris (D) and Stein (G). Dr. Rudolph (Butch) Ware, Dr. Jill Stein’s Vice-Presidential running mate, noted, “The Democrats have lost the Muslim vote. And we are never coming back”.

The Muslim vote in Georgia is estimated as at least 6 or 8 times the margin of victory which gave Biden the Georgia electoral college votes over Trump in 2020.

The United Nations Human Rights Council appointed Reem Alsalem as Special Rapporteur on violence against women and girls, its causes and consequences. On July 8, 2024, she publicized her communication to the government of Greece regarding her concerns about “altruistic… Continue Reading →

Understanding Stein campaign hostility to Georgia Green Party From press releases published by the Green Alliance for Sex-Based Rights National Green Party Sacrifices Credibility for Gender Cult https://greenalliance.sexbasedrights.org/media_pr/2024/08/National_Green_Party_Sacrifices_Credibility_for_Gender_Cult Georgia Green Party Rejects Platform Challenge to Support for Declaration on Women’s… Continue Reading →

The overseas ballots have been mailed. Clock is ticking. What have you done today, to deliver the vote for the slate of the Georgia Green Party? Have you contributed yet financially to helping us do so?

Jill Stein and Butch Ware on The Breakfast Club, 2024-Sept-12.

Jill Stein and Butch Ware on The Breakfast Club, 2024-Sept-12.

Georgia Green Party Prepared to Appeal Judge Malihi Order

Legal options still open to Georgia Green ballot access efforts

Party remains ready to offer ballot qualified opposition to war and genocide

In a series of rulings adverse to the cause of political independence Administrative Law Judge Michael Malihi found reason to support each of the ballot qualification challenges filed by Democrat voters. Those Democrats seek to deny Georgia voters inclined to vote for Green and independent candidates an opportunity to see their candidates of choice on the Georgia ballot.

Judge Michael Malihi presides over ballot access challenges.

Judge Michael Malihi presides over ballot access challenges.

Picture Credit: Natrice Miller, AJC

Among those adverse rulings, in the case Pigg et al vs Carr et al (the Georgia Green Party slate for Presidential Electors), Judge Malihi rejected every contention of challengers but one. The Court found that the Georgia Green Party is a registered political body in Georgia and is in compliance with respect to how its Conventions were publicized and conducted, and how its slate of candidates for Presidential Electors was qualified. The Judge found that the one shortcoming was in the party’s ability to document its place on the ballot in twenty other states under a new statute adopted this past Spring.

“One cannot produce documents which do not yet exist”, said Hugh Esco, Secretary of the Georgia Green Party and the sole witness called in the case. “As our testimony made clear, Secretary Raffensberger has asked us to produce documents, many of which do not need to be filed in other states until up to three weeks after his early deadline for our filing with his office here in Georgia. This deadline undermines the intention of the General Assembly and the early date imposed serves no compelling governmental interest.”

Party officers were not surprised by the ruling given the limits imposed by the administrative procedures act which prohibit the consideration of Constitutional concerns by Administrative Law Judges. Judge Malihi’s Initial Order is now sent to the Secretary of State to inform their final determination.

“We hope though that the Secretary’s office will collaborate with us in recognition of the obvious Constitutional issues raised by the early deadline and save us all the trouble of an appeal to Fulton Superior Court,” said Craig Webster, counsel for Georgia Green Party respondents.

— 30 —

Executive Summary and Table of Contents

for Supporting Documents for Georgia Green Party’s 21-2-172(g) Affidavit

Supporting_Documentation–executive_summary–toc

Decision of Judge Michael Malihi

Initial_Order–Pigg-v-Carr–2502871–20240826

Georgia Green Party

https://georgiagreenparty.org/